Can I use an FD to get a loan and then open another FD for profit?

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on Jan 31, 2025

He has an MBA in finance from the University of Madras and is a certified financial planner.

He is the director and chief financial planner at Holistic Investment, a Chennai-based firm that offers financial planning and wealth management advice.... more

I have an FD of 1 lac at 7.5% interest for 24 months tenure. I understand I can take a loan against this FD for upto 90% of the value of the FD at 1% on top of the interest rate. What stops me from taking the Rs 90K and starting another FD @7.5% interest rate? Am I missing something because it sounds like a no-brainer.

Your bank allows a loan of up to 90% against this FD at 8.5% interest.

You are considering taking Rs. 90,000 as a loan and placing it in another FD at 7.5%.

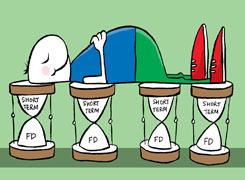

This cycle can continue, creating a chain of FDs and loans.

At first glance, this seems like a way to earn interest while leveraging loans.

The Hidden Costs of This Strategy

The loan interest is higher than the FD interest by 1%.

Over time, the gap in interest rates eats into returns.

Every FD created with loaned money earns less than the cost of the loan.

This results in a compounding loss, not gain.

Instead of profits, you accumulate more liabilities.

Loan Interest vs. FD Returns

The effective return from an FD is reduced when using borrowed funds.

The 1% extra interest on the loan cancels out the FD gains.

Your net return turns negative after tax and compounding effects.

Borrowing to reinvest in FDs is not wealth creation.

It increases your financial burden over time.

Impact of Taxes on Returns

FD interest is fully taxable as per your tax slab.

If you are in the 30% tax bracket, your post-tax FD return is much lower.

The loan interest is an expense, but you cannot claim a tax benefit.

The real return from the FD loan cycle becomes negative after tax.

Banks Benefit, Not You

Banks always earn more from this structure.

They collect loan interest at 8.5% while paying you only 7.5% on FDs.

Banks also charge processing fees and renewal charges.

You end up paying more in interest than you earn.

Instead of growing wealth, you help banks make profits.

Liquidity Issues and Loan Repayment

Loan against FD must be repaid, usually within the FD tenure.

If not repaid, the bank can close your FD to recover the amount.

Rolling the loan into new FDs creates a cycle of dependency.

If you face an emergency, you may struggle with cash flow.

This approach reduces financial flexibility.

Better Alternatives for Investment

Instead of creating a loan-FD loop, consider investing in better options.

Actively managed mutual funds offer better long-term returns than FDs.

Debt mutual funds give stable returns with lower tax liability.

If you want safe investments, consider PPF or tax-free bonds.

Wealth creation happens by investing smartly, not by taking unnecessary loans.

Final Insights

Taking a loan to reinvest in FDs does not work.

Loan interest exceeds FD returns, leading to a financial loss.

Tax reduces the effective FD return even further.

Banks benefit from this structure, not investors.

Avoid financial strategies that create unnecessary liabilities.

Focus on investments that grow wealth efficiently.

A well-planned portfolio gives better results than an FD-loan cycle.

Best Regards,

K. Ramalingam, MBA, CFP

Chief Financial Planner

www.holisticinvestment.in

https://www.youtube.com/@HolisticInvestment

Best Regards,

K. Ramalingam, MBA, CFP,

Chief Financial Planner,

www.holisticinvestment.in

https://www.youtube.com/@HolisticInvestment

You may like to see similar questions and answers below

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on Apr 25, 2024

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on May 18, 2024

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on Feb 04, 2025

Milind Vadjikar | Answer |Ask -Follow

Insurance, Stocks, MF, PF Expert - Answered on Jan 29, 2025

Nayagam P P |10854 Answers |Ask -Follow

Career Counsellor - Answered on Dec 14, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 14, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 14, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 14, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 13, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025