Can I Take a Loan Against My FD to Start Another? (7.5% Interest)

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on Feb 04, 2025

He has an MBA in finance from the University of Madras and is a certified financial planner.

He is the director and chief financial planner at Holistic Investment, a Chennai-based firm that offers financial planning and wealth management advice.... more

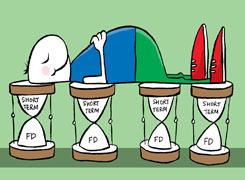

Hello Mr Rego, I have an FD of 1 lac at 7.5% interest for 24 months tenure. I understand I can take a loan against this FD for upto 90% of the value of the FD at 1% on top of the interest rate. What stops me from taking the Rs 90K and starting another FD @7.5% interest rate? Am I missing something because it sounds like a no-brainer.

Interest Rate Spread

The bank charges 1% extra on the loan. This means your new FD will earn 7.5%, but your loan will cost you 8.5%. So, you are already at a loss of 1% annually.

Compounding vs. Simple Interest

FDs earn compound interest, but loans often charge simple interest. Over time, this difference will widen your losses. The compounding effect on the FD won’t be enough to cover the interest burden on the loan.

Processing Fees & Other Charges

Banks may charge processing fees, renewal fees, and other hidden costs on loans against FDs. These additional costs further eat into any potential gains.

Liquidity Issues

Once you take a loan against your FD, your money is locked. If an emergency arises, breaking the FD early might incur penalties. Having too many locked-in funds reduces financial flexibility.

Taxation Impact

Interest earned on FDs is taxable, but the interest paid on loans is not tax-deductible. This creates a tax inefficiency, increasing your overall financial burden.

Credit Score Risk

Taking a loan against FD may not directly affect your credit score. But if you fail to repay interest on time, it will be reported, impacting your ability to get other loans in the future.

Better Investment Options

Instead of this cycle, you could explore other investment options that generate higher returns than an FD without locking you into debt. Mutual funds, debt funds, or corporate FDs could offer better growth potential with controlled risk.

Final Insights

On paper, taking a loan against FD and reinvesting sounds profitable. But when you factor in interest spread, taxation, liquidity, and hidden costs, it’s not a wise strategy. Instead, consider diversifying your investments into better-yielding instruments while maintaining liquidity for emergencies.

Best Regards,

K. Ramalingam, MBA, CFP,

Chief Financial Planner,

www.holisticinvestment.in

https://www.youtube.com/@HolisticInvestment

You may like to see similar questions and answers below

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on Apr 25, 2024

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on May 18, 2024

Ramalingam Kalirajan |10881 Answers |Ask -Follow

Mutual Funds, Financial Planning Expert - Answered on Jan 31, 2025

Nayagam P P |10854 Answers |Ask -Follow

Career Counsellor - Answered on Dec 14, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 14, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 14, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 14, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 13, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025