Is investing around 5 lakhs in Fd at Repco bank is safe?

Ans: It's great to see you thinking carefully about where to invest your hard-earned money. Investing in a fixed deposit (FD) is a common and safe option for many. But you’ve raised a good question: Is it safe to invest Rs. 5 lakhs in an FD at Repco Bank? Let’s explore this thoroughly to give you a clear perspective.

Understanding Fixed Deposits and Their Safety

Fixed Deposits are a popular investment choice in India. They offer:

Guaranteed Returns: Interest rates are fixed, providing certainty on returns.

Safety: Capital protection is assured, as FDs are not subject to market risks.

Liquidity: You can withdraw your money anytime, although early withdrawals may incur penalties.

For FDs, the safety depends on the financial health of the bank where you invest. Let's dive deeper into assessing the safety of Repco Bank.

Assessing Repco Bank’s Financial Stability

Before investing in any bank’s FD, it's essential to evaluate the bank's financial health. Here’s how you can do it for Repco Bank:

Bank’s Background and Size:

Repco Bank, established in 1969, is a government-promoted bank, primarily serving the southern states of India.

It’s relatively smaller compared to major nationalized banks, but it has a strong regional presence.

Financial Performance:

Review the bank’s financial statements. Look for profitability, non-performing assets (NPAs), and capital adequacy ratios (CAR).

Repco Bank's financials are typically available in its annual reports. You should check their website for the latest updates.

Credit Ratings:

Credit rating agencies like CRISIL and ICRA rate banks based on their creditworthiness.

Check Repco Bank's latest credit rating. A high rating (like AAA or AA) indicates strong financial health and low risk.

Government Support:

As a government-supported bank, Repco Bank benefits from a certain level of trust and backing, which can be reassuring for depositors.

Regulatory Compliance:

Banks in India are regulated by the Reserve Bank of India (RBI). Ensure Repco Bank complies with all RBI guidelines and has a good standing with the regulator.

Evaluating FD Investment Safety

To determine the safety of your Rs. 5 lakhs in an FD at Repco Bank, consider these factors:

Deposit Insurance:

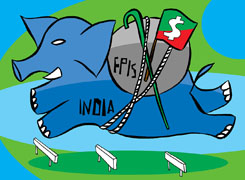

DICGC Insurance: In India, the Deposit Insurance and Credit Guarantee Corporation (DICGC) insures deposits up to Rs. 5 lakhs per depositor per bank.

If Repco Bank faces financial trouble, your deposits up to Rs. 5 lakhs are protected by DICGC insurance.

Interest Rates:

Compare the interest rates offered by Repco Bank with other banks.

Higher interest rates might indicate higher risk, as banks sometimes offer attractive rates to attract deposits.

Investment Tenure:

Choose an FD tenure that aligns with your financial goals. Longer tenures may offer higher interest rates, but assess if you need liquidity.

Premature Withdrawal Policies:

Check Repco Bank's policies on premature withdrawals. Know the penalties and conditions if you need to access your funds early.

Alternative Safe Investment Options

If you’re unsure about investing in Repco Bank’s FD, consider these alternatives:

Nationalized Banks:

Large public sector banks like SBI, HDFC, and ICICI offer higher security due to their size and government backing.

They also have extensive deposit insurance and strong financial stability.

Post Office Schemes:

Post Office FDs and other schemes like NSC (National Savings Certificate) are backed by the government and offer secure returns.

They are considered one of the safest investment options in India.

Debt Mutual Funds:

If you’re looking for slightly higher returns with moderate risk, consider short-term debt mutual funds.

These funds invest in government and corporate bonds, providing better liquidity and potential for higher returns compared to FDs.

Corporate FDs:

Some companies offer corporate FDs with higher interest rates. Ensure they have a strong credit rating (AAA or AA) to mitigate risks.

Steps to Make an Informed Decision

To confidently decide whether to invest your Rs. 5 lakhs in an FD at Repco Bank, follow these steps:

Do Your Research:

Thoroughly review Repco Bank’s financial health and recent performance. Check their latest annual reports and credit ratings.

Compare Options:

Look at the FD rates and safety of other banks. Consider government banks, post office schemes, and reputed private banks.

Consult a Certified Financial Planner:

Get personalized advice from a Certified Financial Planner (CFP). They can provide insights tailored to your financial goals and risk appetite.

Evaluate Your Risk Tolerance:

Determine how much risk you’re willing to take. If you prefer complete safety, opt for nationalized banks or post office schemes.

Read the Fine Print:

Understand all terms and conditions of Repco Bank’s FDs, including interest rates, maturity periods, and penalties for early withdrawal.

Benefits of Regular Funds Over Direct Funds

If you ever consider investing beyond FDs, especially in mutual funds, it's important to know the difference between regular and direct funds:

Regular Funds:

These involve a distributor or advisor who helps manage your investments.

Investing through a Mutual Fund Distributor (MFD) with CFP credentials gives you access to expert advice and personalized strategies.

Direct Funds:

You invest directly with the fund house, saving on distributor fees.

However, managing and selecting funds without professional advice can be complex and time-consuming.

Why Choose Regular Funds:

The slightly higher cost of regular funds is often justified by the benefits of professional guidance and ongoing support from an MFD with CFP credentials.

Active Management vs. Index Funds

If you decide to diversify your investment portfolio, understanding the difference between actively managed funds and index funds is crucial:

Actively Managed Funds:

Fund managers actively select stocks and manage the portfolio to outperform the market.

These funds often offer higher returns, especially in volatile markets, due to skilled management.

Index Funds:

These funds track a market index and aim to replicate its performance.

They have lower costs but usually deliver market-average returns, lacking the potential for outperformance seen in actively managed funds.

Benefits of Actively Managed Funds:

Active funds provide flexibility and the opportunity for higher returns, especially beneficial for medium to short-term goals like your 3-year investment horizon.

Final Insights

Investing Rs. 5 lakhs in an FD at Repco Bank is a safe choice with certain considerations. Here’s a wrap-up of the key points to help you decide:

Evaluate Repco Bank’s Financial Health:

Check their credit ratings, financial performance, and compliance with RBI regulations.

Understand Deposit Insurance:

Your Rs. 5 lakhs investment is protected by DICGC insurance, providing security in case of any bank issues.

Compare with Alternatives:

Consider the safety and returns of FDs in nationalized banks, post office schemes, or other reputed institutions.

Consider Professional Guidance:

Seek advice from a Certified Financial Planner to align your investments with your goals and risk profile.

Look Beyond FDs:

For higher returns, explore options like debt mutual funds or balanced mutual funds, keeping in mind their risk profiles.

Stay Informed and Vigilant:

Regularly review your investments and stay updated on financial trends to make well-informed decisions.

Remember, every investment comes with its own set of risks and rewards. It’s important to choose the one that best aligns with your financial goals and risk tolerance. If you have any more questions or need further guidance, don’t hesitate to reach out.

Best Regards,

K. Ramalingam, MBA, CFP,

Chief Financial Planner,

www.holisticinvestment.in