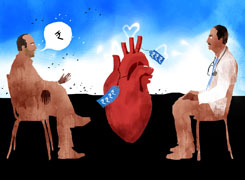

My Father Had a Mini Heart Attack and Now Has Tightness in His Hands and Legs Again - What Should I Do?

Dr Karthiyayini Mahadevan | Answer |Ask -Follow

General Physician - Answered on Apr 21, 2024

She specialises in general medicine, child development and senior citizen care.

A graduate from Madurai Medical College, she has DNB training in paediatrics and a postgraduate degree in developmental neurology.

She has trained in Tai chi, eurythmy, Bothmer gymnastics, spacial dynamics and yoga.

She works with children with development difficulties at Sparrc Institute and is the head of wellness for senior citizens at Columbia Pacific Communities.... more

Hello doctor, my father had a mini heart attack in September. He was experiencing asthma and jhanjhanahat (I don't know what else can I call it) in shoulders and hands . His hands would get tight all of a sudden and it would pain a lot. He used to go to a pulmonologist for asthma but he overlooked all of these and suggested to put volini spray on it. So when he got the heartattack his left body got paralysed for a while and after that he was fine. The doctor said that there was blockage in artery so he got a surgery done where the stunt was placed near waist. We maintained a good diet after that but when he got back to his house my brother's wife would not care much about the diet and fed him oils and refined oil as much as she could. Now it has been 7 month now he has been experiencing tightness in hands and legs again. Please suggest doctor. I fear that he might get heart attack once again.

You may like to see similar questions and answers below

Dr Karthiyayini Mahadevan | Answer |Ask -Follow

General Physician - Answered on Apr 23, 2024

Nayagam P P |10854 Answers |Ask -Follow

Career Counsellor - Answered on Dec 14, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 14, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 14, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 14, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 13, 2025

Dr Dipankar Dutta |1840 Answers |Ask -Follow

Tech Careers and Skill Development Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025

Radheshyam Zanwar |6744 Answers |Ask -Follow

MHT-CET, IIT-JEE, NEET-UG Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025

Mayank Chandel |2575 Answers |Ask -Follow

IIT-JEE, NEET-UG, SAT, CLAT, CA, CS Exam Expert - Answered on Dec 13, 2025